Evaluation of the Patent Portfolio

The intention is to identify and analyse the patent portfolio of each competitor company, through the main benchmarks L'intenzione è di identificare ed analizzare il portafoglio brevettuale di ciascuna azienda concorrente, mediante i principali indicatori ricavabili dal brevetto, e compararlo con il portafoglio brevetti dell'azienda richiedente.

L’azienda, inoltre, è interessata ad ottenere anche un confronto dei portafogli brevettuali basata su di un indicatore che ne definisca, in maniera quanto più possibile oggettiva, la qualità/forza.

The scouting has been divided into two phases:

- Identification of competitors and similar companies, and reconstruction of their patent portfolios;

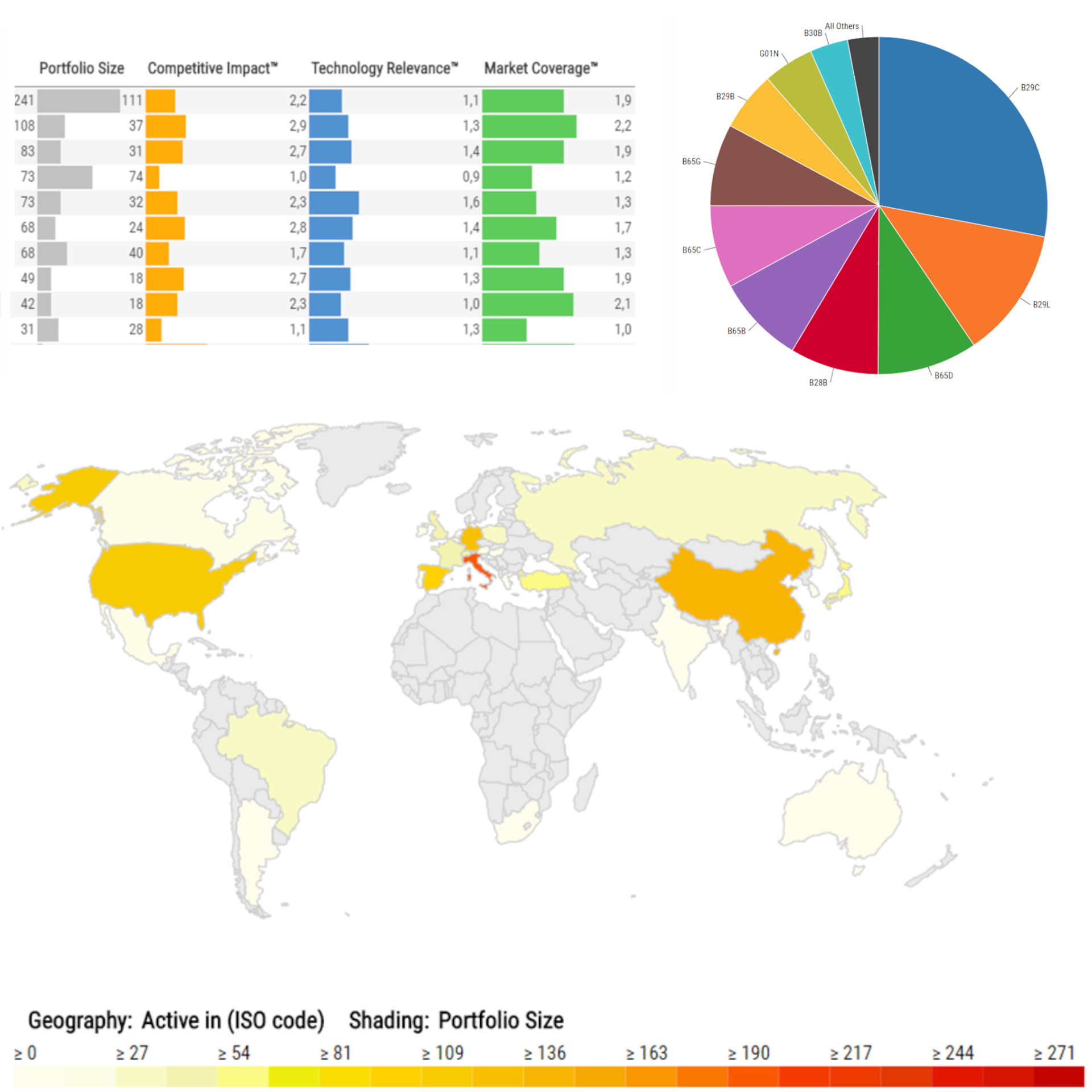

- Evaluation and comparison of portfolios based on the characteristics of patent families and aggregate indices.

To carry out the activity was done using Derwent Innovation and Patentsight, patent databases able to provide different details on patent families.

Derwent Innovation allows for more information on the various families and patents within them, while Patentsight analyzes the aggregated data, providing indicators on the technological relevance, market coverage and competitiveness of individual families. Furthermore, Patentsight is able to provide an index (Patent Asset Index) that describes the strength and competitiveness of the entire patent portfolio.

The result of the scouting were a series of reports in which each company’s patent portfolio was analyzed in terms of family characteristics and strength. The results were compared with those obtained for the requesting company.

In recent years we have witnessed an increase in pressure to innovate and generate satisfactory financial returns from innovation. This market push has generated a revaluation of intellectual property rights (IP).

A growing number of companies have adopted strategies on the exploitation of intellectual property and have invested in the creation of an internal organization dedicated to its management.

The main advantage of an active management of the patent portfolio is to use the rights deriving from a patent to obtain a temporary exclusive position on the market, avoiding, or at least postponing, the imitations by competitors. Furthermore, an in-depth knowledge of its patent portfolio makes it possible to evaluate the marketing of licenses or obtain access to technological knowledge outside the company, through cross-licensing or establishing alliances in research and development.

Therefore, in order for the patent portfolio to become a strategic resource for the company, it must not be managed only in terms of size but also in terms of quality and value of the patents.

The Technology Scouting allowed the applicant company to understand which of its patent families are the most competitive in terms of market value and as a corporate asset.

Furthermore, the comparison with competitors and similar companies made it possible to understand the strengths and weaknesses of the portfolio, producing a greater awareness of which features (quality, size, technological relevance and geographical coverage) it is necessary to invest in so that intellectual property becomes a strategic resource.

Contact Us

Are you interested in receiving more detailed information about CRIT and its services? Please fill out the form below and you will be contacted shortly.

"*" indicates required fields